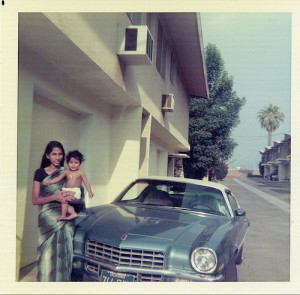

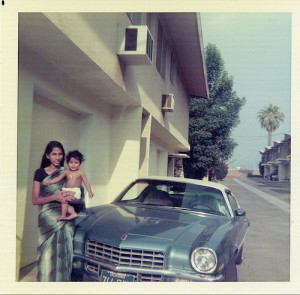

Where am I from? I was born in Southern California, to immigrants from India, thanks for asking.

Last week, while in an elevator, a well-dressed, slightly-older woman looked at me intently and said, “You have interesting skin,” before asking its origin.

I have dark skin, black hair and large brown eyes.

Despite the fact that this issue has been written about over and over and over again, people still don’t get that asking “Where are you from?” is problematic on many levels. The question may come from a good place, but it often puts the recipient in a bad one. It’s also worth considering who gets asked about their origins and who doesn’t. If you don’t ask everyone where they are “from”, why not? Why is the question frequently aimed at people who have darker skin, immigrant parents and yes, interesting backgrounds, if not to emphasize difference?

Here are some ways to ask someone about their heritage without sounding boorish or entitled:

Use a compliment. Sports Illustrated model Chrissie Teigen is asked about her Norwegian-Thai ancestry daily and doesn’t mind, but she had this advice for the curious: “I usually go with ‘What’s your background, you are beautiful”.

Be direct about what you are asking. On DCentric’s Facebook page, reader Laurie Peverill volunteered that she asks strangers about their “family history”, instead of the nebulous “Where are you from?” She adds, “Assuming that very few of us are actually from here originally, everyone has a great answer.”

Ask other questions first. DCentric reader Jasmin Thana also used Facebook to convey how she is dismayed that “Where are you from?” is often the first question strangers ask her. “Know my name first. Have a conversation with me, then you can ask where my ancestors are from. The question annoys me because they’re trying to put me in a box and if people just guess correctly, the look on their face is like they just won a prize.”

In a DCentric post from April, my colleague Elahe wrote, “All of this isn’t to say that I, or other second-generation Americans, aren’t also proud of our heritage and roots.” But the hope is that one day, people will be content to see the children of immigrants as peers, and not ethnic riddles to be solved.