Expensive rents can be a byproduct of gentrification and rising property values. So isn’t rent control one way to keep housing affordable?

Turns out that it’s not always that simple.

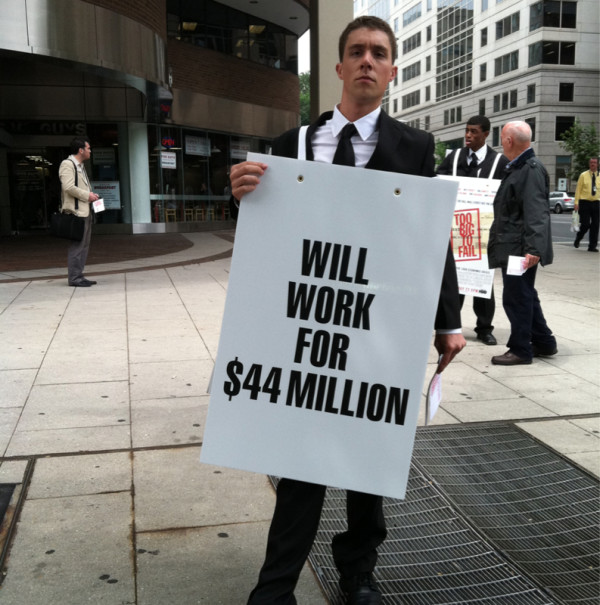

This week’s Washington City Paper Housing Complex column explores how one developer’s approach to purchasing and renovating old apartment buildings in D.C. has become a double-edged sword for renters. When landlords wants to sell their buildings, a D.C. law requires that they offer tenants the first right to buy. Urban Investment Partners buys old buildings, but they get the tenants to waive their right to purchase by striking deals that include keeping rents relatively stable for original tenants. Those old buildings need major renovations, and the company pays for them by substantially increasing rents for newcomers to the building. The result: rent-controlled, low rates for those who remain, but the number of affordable apartments in the building — and the city– declines.

But what other options exist? The pot of money intended to preserve affordable housing in the District is dwindling. For-profit developers want to make money, and it’s difficult to massively renovate a building without charging people more to live there.

These issues disproportionately affect people of color in the District. About twice as many African Americans, Asians and Latinos rent rather than own homes in D.C. Meanwhile, nearly the same number of whites own homes as rent them in D.C. About 55 percent of people who live in D.C. rent.