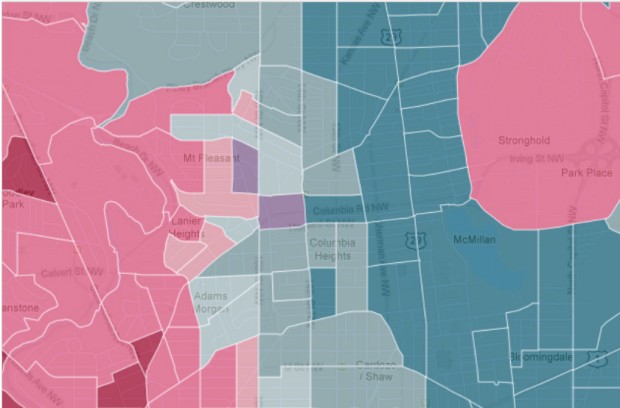

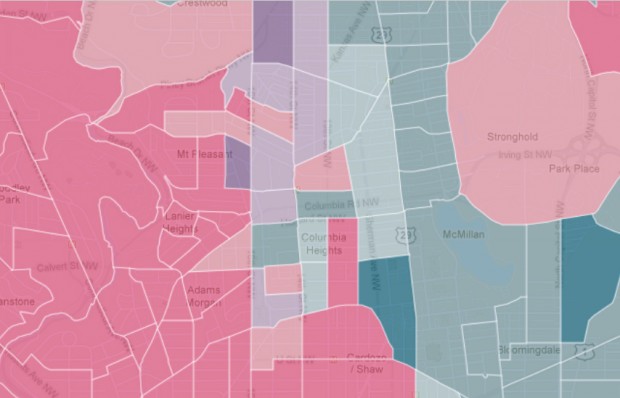

A new Brookings Institution report on affordable housing in D.C. notes that between 2000 and 2009, home ownership increased by almost 45 percent. But the rate jump wasn’t felt evenly across class lines; home ownership actually declined among households making less than $50,000 annually:

Percentage change between 2000 and 2009

| Household incomes | Renters | Homeowners | Overall |

| Less than $50,000 | -24 percent | -32 percent | -26 percent |

| $50,000 to $75,000 | Unchanged | Unchanged | Unchanged |

| More than $75,000 | +81 percent | +58 percent | +63 percent |

(Source: Brookings Institution)

In the span of nearly 10 years, D.C. experienced an increase in the number of people with more money and a decrease in the number of people with less money.

This new report is an update on one issued five years ago, which had recommended increasing the rate of home ownership to help boost affordable housing. But housing prices in the District are increasing, so naturally it’s becoming more and more challenging for lower income people to buy homes. Some lower-income home owners are finding it increasingly beneficial to sell their properties that have appreciated so much in value.

Even knowing exactly how much affordable housing there is in D.C. has proven to be difficult, researchers noted. The report recommended improving the process of documenting the housing stock, and included other suggestions such as increasing property taxes to raise money for affordable housing.